My Blog List

Thursday, January 26, 2012

Mexican Stock Exchange Launches World’s Third Sustainability Index

The Mexican Stock Exchange recently launched its own Sustainability Index, the third of its kind in the world. Together with the Dow Jones Sustainability and FTSE 4Good indices, the Mexican Sustainability Index will allow member companies to realize an additional equity value as they implement sustainability practices across their organizations. Also, through the Sustainability Index, member firms will support Mexico’s commitment to reduce greenhouse gas emissions by 30 percent in 2020.

Check out MexicoToday.org for more stories on how Mexico improves its economy while implementing innovative sustainability practices.

Saturday, January 21, 2012

Mexico Investment Summit Starts this January 31

The Mexico Investment Summit is an annual conference that brings together senior decision makers from the entire investment and development community. At the summit, only the top pension funds, family offices, fund of funds, fund managers, development banks, developers and government officials attend the 3 action-packed, content rich days.

According to Jeffrey M. Jones, Venture Partner at Alta Growth Capital, "The Mexico Investment Summit focuses on a country that many consider to be the world's best combination of logistically based geography and phenomenal natural resources, a discussion important not only for its positive internal impacts, but for it's strategic effects on North American and world competitiveness."

Check out more details on the Mexico Investment Summit here.

Tuesday, January 17, 2012

Investors Ignore Downgrade: Mexico Pesos Rises

Via Bloomberg.com:

Mexico’s peso rose to a one-month high as investors at a Spanish debt auction shrugged off last week’s downgrade of the European nation, fueling optimism for global growth and the Latin American country’s exports.

Mexico’s peso rose to a one-month high as investors at a Spanish debt auction shrugged off last week’s downgrade of the European nation, fueling optimism for global growth and the Latin American country’s exports.

The peso strengthened 0.5 percent to 13.4795 per U.S. dollar at 8:32 a.m. in Mexico City, from 13.5528 yesterday. The currency touched 13.4507 in intraday trading, the strongest level since Dec. 8. It’s appreciated 3.4 percent this year after tumbling 11.5 percent in 2011.

“The placement of sovereign debt had favorable results,” Rafael Camarena, an economist at Banco Santander SA in Mexico City, said in a telephone interview. “Basically, despite all the news that we’ve seen about Europe, financial markets didn’t see it as being bad. This is improving the European environment, benefitting emerging-market currencies including the peso.”

Interactive Map: The Economy Where You Live

Via NPR.org:

The fallout from the recession has cut deeply into the housing security, employment and income of many Americans. But some parts of the country are clearly faring better than others. Here, three interactive maps show foreclosure and jobless rates as well as household income by county.

Mexico: Leading Foreign Home Buyer in U.S.

Apparently, those in a favored position in the U.S. aren't the only ones that are investing in the housing market lately. According to a recent report by the National Association of Realtor's, now it is the foreign home buyers that are leading the housing market. Susan Wachter, professor of real estate and finance at The Wharton School, University of Pennsylvania, confirms this: “Housing is more affordable than ever,” she says, adding, “It’s difficult to get credit now but international investors come with cash.”

Foreign homebuyers, she added, also see the United States as a good investment bet. “In this period of tremendous uncertainly globally, real estate here is a safe haven,” she maintained.

Our neighbor to the South, Mexico, is the top country where foreigners come from to buy U.S. homes.

Monday, January 16, 2012

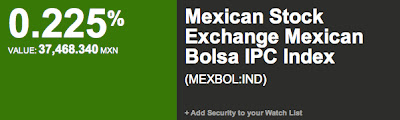

Mexican Stock Exchange: Update

Below is an update for Mexican Stocks. The following companies had unusual price changes in Mexico trading. (Stock symbols are in parentheses and prices are as of the close of trading.)

Overall, the IPC index rose 1 percent to 36,916.16.

Mexican stocks followed European equities improved performance as France auctioned debt at a lower borrowing cost after Standard & Poor’s lowered its credit rating.

Controladora Comercial Mexicana SAB (COMERUBC), a Mexican supermarket chain, gained 4 percent to 26.21 pesos. Fomento Economico Mexicano SAB (FEMSAUBD), Latin America’s largest Coca-Cola bottler, rose 1.1 percent to 92.98 pesos. America Movil SAB (AMXL) , the wireless carrier controlled by billionaire Carlos Slim, rose 1.1 percent to 15.30 pesos.

Alfa SAB (ALFAA) , Mexico’s largest privately-owned chemical company, jumped 8.6 percent to 170.99 pesos.

Thursday, January 12, 2012

Remittances to Mexico are Rebounding

Mexicans living in the U.S. are experiencing the improvement of the U.S. job market. According to the latest reports, remittances back to Mexico increased by 8 percent compared to the same periods in 2010.

This marks the end of a three-year slump that money transfer services have seen and Mexico remittances accounted for $23 billion of the total amount of revenue.

The data states that this increase is due to an improving U.S. job market. An example of the upward trend can been by money transfer companies such as Money transfer giant Western Union Co., whose revenue sagged during the recession, saw its remittance business strengthen in 2011. The Colorado company reported a 5 percent increase in revenue from its Mexico business in the third quarter compared with the same period in 2010. Its stock price is up more than 13 percent during the last three months.

Wednesday, January 11, 2012

U.S. Stocks Fall as Europe Threatens Growth

U.S. stocks fell, snapping a two-day advance for the Standard & Poor’s 500 Index, amid concern that Europe’s debt crisis will stifle global economic growth.

Nine out of 10 groups in the S&P 500 fell as energy shares had the biggest decline. Microsoft Corp. (MSFT) lost 0.5 percent after saying industrywide sales of personal computers will probably be lower than analysts projected. Urban Outfitters Inc. (URBN) tumbled 19 percent as its chief executive officer resigned. Supervalu Inc. (SVU) sank 10 percent as earnings missed estimates.

IMF Chief Applauds Mexico: Calls Latin America a Model for the Rest of the World

International Monetary Fund (IMF) chief Christine Lagarde said in an interview that Brazil, Mexico and Peru have done remarkably well improving their economies over the past few years and can provide some lessons to other advanced countries.

The IMF chief has very specific ideas on how other economically stressed countries can benefit from the Latin American model. The chief explained that lessons “such as saving for a rainy day, and making sure that risks in the banking system are under control…I believe Latin America is now on a firm foundation, and can look ahead to lasting prosperity and stability that can lift the living standards of all.”

Lagarde went on to explain that Mexico in particular, is a country “in a unique position to shape our collective economic destiny over the coming year.”

Tuesday, January 10, 2012

Mexico More Encouraging Towards Technological Innovation than U.S. and U.K.

According to "The Evolving Workforce" survey conducted by Dell and Intel, Mexico, China and other developing economies are shifting to server virtualization faster than the United States and the United Kingdom.

"The virtualization rates are lowest where there are the highest legacy systems," said Bryan Jones, director of European marketing at Dell. He continued, saying that developing countries find it easier to be innovative by creating new systems, because there are no legacy systems in place. There is also more hesitance to change, according to a survey, 83 percent of Mexicans and 76 percent of Brazilians believe that it’s good when "technology and the Internet to allow [them] to do business in different ways," compared with 43 percent of U.K. workers and 46 percent of U.S. workers.

Major International Automobile Companies Keep Investing in Mexico

During the last 5 years, foreign investment in the Mexican automotive sector has totaled more than 10 billion dollars, with investment by major international companies.

Three American manufacturers, GM, Ford, and Chrysler, the leading German carmaker Volkswagen, and major Japanese companies such as Nissan, Honda, Mazda and Toyota operate assembly plants in Mexico, and together produce 40 car models in the country.

Out of the top 100 auto parts companies in the world 84 have set up manufacturing operations in Mexico. The country’s auto plants have received international awards and recognition for their high levels of productivity and quality.

Three American manufacturers, GM, Ford, and Chrysler, the leading German carmaker Volkswagen, and major Japanese companies such as Nissan, Honda, Mazda and Toyota operate assembly plants in Mexico, and together produce 40 car models in the country.

Out of the top 100 auto parts companies in the world 84 have set up manufacturing operations in Mexico. The country’s auto plants have received international awards and recognition for their high levels of productivity and quality.

Monday, January 9, 2012

Mexico Coffee Exports Rose Almost 25% in December

According to Amecafe, a local industry group, Mexican coffee rose approximately 23 percent in December. Exports for the 2011-2012 season started in Oct. 1 climbed 52 percent to over 500,000 bags, Amecafe data show.

Big Opportunities in Latin America for U.S. Companies

“There are big opportunities in Latin America,” says Mr. Diez Barroso, great-grandson of the Televisa founder. “But a lot of the [U.S.] companies I talk to have resources committed to Asia – and not Latin America.”

A new joint venture, between a new bank, Evolution Media Capital, and Creative Artists Agency aims to make it easier for U.S. institutions and other groups to identify film, television and sports investments in the U.S. and Latin America. This is something that is becoming increasingly attractive thanks to sharp growth in the region’s media sector.

Mr. Diez Barroso said the joint venture would become a “gateway” for the region creating opportunities for U.S. investors that had previously been limited to wealthy individuals or families from Latin America. “We want to provide an access point for these deals,” he told the Financial Times.

Mexican Stock Exchange to Join LatAm Group of Bourses

Via The Financial Times:

The Mexican stock exchange, Bolsa Mexicana de Valores or BMV, has signed a letter of intent to join the Chilean, Peruvian and Colombian bourses in Latin America’s first stock market group.

The objective would be to give the Mercado Integrado Latino Americano (Mila) or Integrated Latin American Market, a significant uplift in trading and initial public offerings, as these regional bourses follow the global trend of stock market integration in recent years .

Mexico's Bolsa Mexicana de Valores is the second-largest exchange in Latin America after Brazil's BOVESPA, with a total market capitalization of more than $450bn. With Mexico on board, it's expected that Mila’s combined market capitalization will exceed $1,000bn.

Wednesday, January 4, 2012

Mexico Sees 16% Rise in Insured Crop Land

Mexico's agriculture ministry will make efforts to assist producers in acquiring insurance against natural disasters for 9.4 million hectares (23.2 million acres) of crops in 2012, representing a 16 percent increase in insured land from last year.

Corn and beans are among the crops most likely to benefit from the increase in insurance coverage, according to the ministry's Public Information Office, due to their vulnerability to freezing and drought.

Green Solutions 2011 showcases eco-friendly products

The Green Solutions 2011 fair was recently held in Mexico City to showcase some of the best eco-friendly products on the market. More than 115 companies attended the three-day fair to share products and discuss environmentally sound business practices. Green Solutions at COP16 was the first forum for dialogue between the public and private sectors included in the United Nations Framework Convention on Climate Change, Conference of the Parties (COP). More than 3,300 people from around the world attended the event, including businesspeople, opinion leaders, professionals and envoys.

Mexico: the Host of the Next G-20 Summit in 2012

In June 2012, world leaders will convene in Los Cabos, Mexico to discuss measures to promote the financial stability of the world and how to achieve sustainable economic growth and development at the G-20 Summit. This meeting marks the first time in history that a Latin American country is hosting the summit, an event that brings together top Finance Ministers and Central Bank Governors every year.

Mexico Increases Minimum Wage 4.2%

Mexico's minimum wage commission set the increase for 2012 at 4.2% for all three of the country's geographic zones, slightly above the rate of inflation expected for this year and next.

Starbucks Raises Prices on Tall Coffees in U.S. Northeast, South and Southwest

Starbucks Corp. (SBUX), the world’s biggest coffee shop operator, raised prices on certain beverages in the U.S. Northeast, such as New York City, the South and Southwest to make up for higher costs. The changes are the result of “the cost of doing business,” which includes distribution, materials and commodities, said Jim Olson, a company spokesman, in an email.

The New York City market has raised the price of tall brewed coffees and tall lattes increased by 10 cents, while the price for grande brewed coffees stayed the same.

Tuesday, January 3, 2012

The Dow Jones Industrial Average rose to its highest level since July, amid signs that manufacturing output is increasing in Australia and America.

Bank of America Corp. (BAC) and JPMorgan Chase & Co. (JPM) added more than 4.3 percent as financial shares had the second-biggest gain among S&P 500 industries. Alcoa Inc. (AA) and Caterpillar Inc. (CAT) advanced at least 3.7 percent, pacing increases among the largest U.S. companies. Chevron Corp. (CVX) climbed 3.7 percent as the price of oil rose. Cisco Systems Inc. surged 3.4 percent after JPMorgan recommended investors buy the shares.

“The U.S. market has been cheering because of the fact the U.S. economy has been performing better,” Kevin Shacknofsky, who helps manage about $5 billion for Alpine Mutual Funds in New York, said in a telephone interview. “In line with everything else today, the manufacturing data is better than expected.”

With Operations in Mexico and the U.K., PepsiCo Maintains Strong International Presence and Profits

As one of the largest food and beverage companies worldwide, PepsiCo operates in more than 200 countries – with its largest international operations in Mexico and the United Kingdom.

According to a recent Seeking Alpha article, the company has historically delivered healthy returns to its shareholders. For example, in 2011, the company’s dividend increased for the 39th consecutive year, from $1.89 to $2.06. This represented a 9 percent increase. Despite struggling global economies, PepsiCo reported solid results for the third quarter of 2011 – with revenue jumping up 13 percent, and operating profits up 7 percent.

Mexico's Middle Class Increases Foreign Investment

Mexico’s growing middle class is making its presence known at the cash register. Canadian Dale Wishewan noticed that Mexico City mall lobbies were filled with people dressed in Abercrombie and Fitch while eating at McDonald’s and Starbucks. Today more than 60% of Mexicans are considered middle class. “There is this middle class that wants North American brands,” says Wishewan, chief executive of Booster Juice, a juice and smoothie company.

The 50 peso ($3.70) price of smoothies from Booster Juice would have been out of reach for most Mexicans a few years ago. However, as the economy recovers from the 2008 recession, more Mexicans are turning to more expensive North American brands.

Mexico Trading: Banorte, Alfa, Pemex Experience Positive Growth

Mexico trading: the following companies experienced positive changes yesterday:

- Grupo Financiero Banorte (GFNORTEO MM), the nation’s third largest bank in terms of outstanding loans, gained 0.8 percent to 42.64 pesos.

- Alfa SAB (ALFAA) , the world’s largest producer of aluminum engine heads, gained 1 percent to 153.5 pesos.

- Cemex SAB (CEMEXCPO MM), America’s largest cement maker, advanced 0.4 percent to 7.48 pesos. The index, released by the U.S. Commerce Department, rose 0.8 percent in October.

Mexico, Brazil to Sell Sovereign Debt this 2012

Brazil and Mexico, Latin America’s largest economies, are taking advantage of near record-low borrowing costs and are planning the year’s first emerging-market sovereign debt sales.

Mexico seeks to issue $2 billion worth of 10-year bonds overseas. Mexico may sell the notes at a spread of about 175 basis points (a 1.75 percent gain) while Brazil may pay 150 basis points more than similar-maturity U.S. Treasuries.

Mexican Stocks Rise along with Peso

Mexican stocks closed higher yesterday and the peso strengthened against the U.S. dollar in light trade due to the closer of several foreign markets for the New Year's holiday.

Volume was very light, with just under 18 million shares and the market's IPC index of leading issues finished up 0.7 percent at 37,335 points.

Subscribe to:

Posts (Atom)